One of the most important jobs for rental property investors is to analyze the income & expense. The first step to do this is by having an accurate record. While there are a lot of books and videos available in terms of how to do bookkeeping for rental property investors, I feel there are a few pieces missing. I would like to introduce one of them here.

This blog will show you how to enter owner draw, which is the payment you receive monthly (usually) from your property management company. I am using QuickBooks in the below example, but this should apply to all accounting software. Before I start, I want to emphasize that I am not an accountant and not a tax professional. This blog is just my opinion, so please consult with appropriate professionals for your specific legal or tax advice.

Enter the amount deposited to the bank:

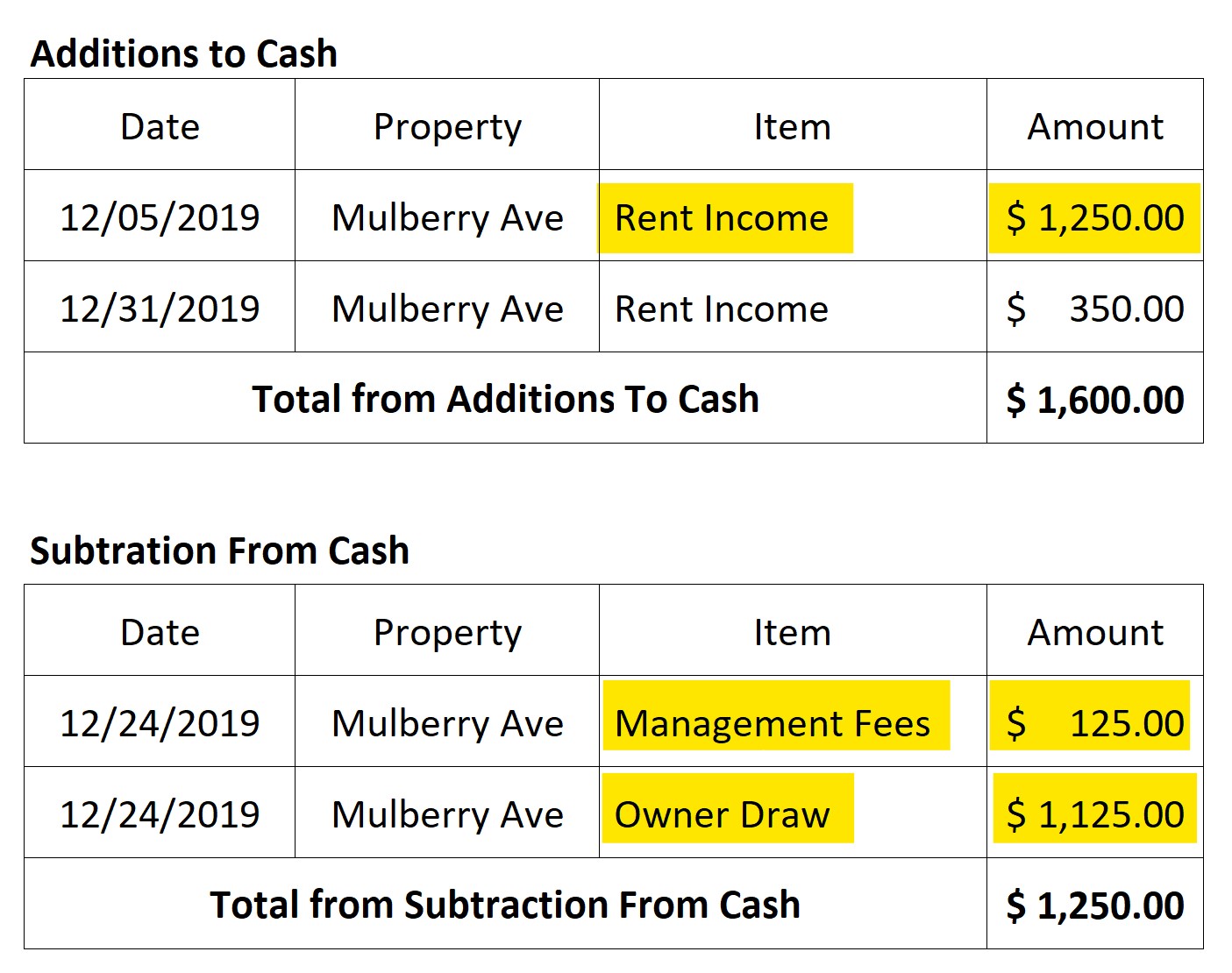

On the surface, entering an owner draw looks like a simple transaction. Let’s say the rent for this particular property on Mulberry Ave is $1,250. Let’s also assume that this particular property management company charges 10% of the rent for the management fee, which will be $125. $1,250 (rent) – $125 (management fee) = $1,125 (owner draw) will be deposited to your bank account. The owner-report from your property management company may look like this.

The transactions will go like this in QuickBooks.

This will actually record the rent, management fee and also matches with the bank account, so reconciliation between the bank account and QuickBooks will be easy. So what is the problem with this method?

There are two problems with this method. One is it'll be hard to reconcile the actual transactions happened within the property management company and the QuickBooks transactions. While at some point the balance will match, the transactions will look different. The actual transactions at the property management company are happening on different days, yet the QuickBooks transactions and the actual bank transactions will have all in one day with one number. This will make it harder to reconcile.

Another problem is the transaction happened after the owner draw date will cause an issue. You might have caught it, but it is the $350 that was received on 12/31/2019.

We don't know why the tenant decided to pay the rent on 12/31/2019, but this clearly creates a problem. Since the property management company already paid the December 2019 draw, you will not receive the $350 (minus the management fee) till January 2020. This will under report the 2019 income and over report the 2020 income. Same thing can be said is there's an expense paid after the owner draw. So what is the solution?

Enter the property management company's transactions:

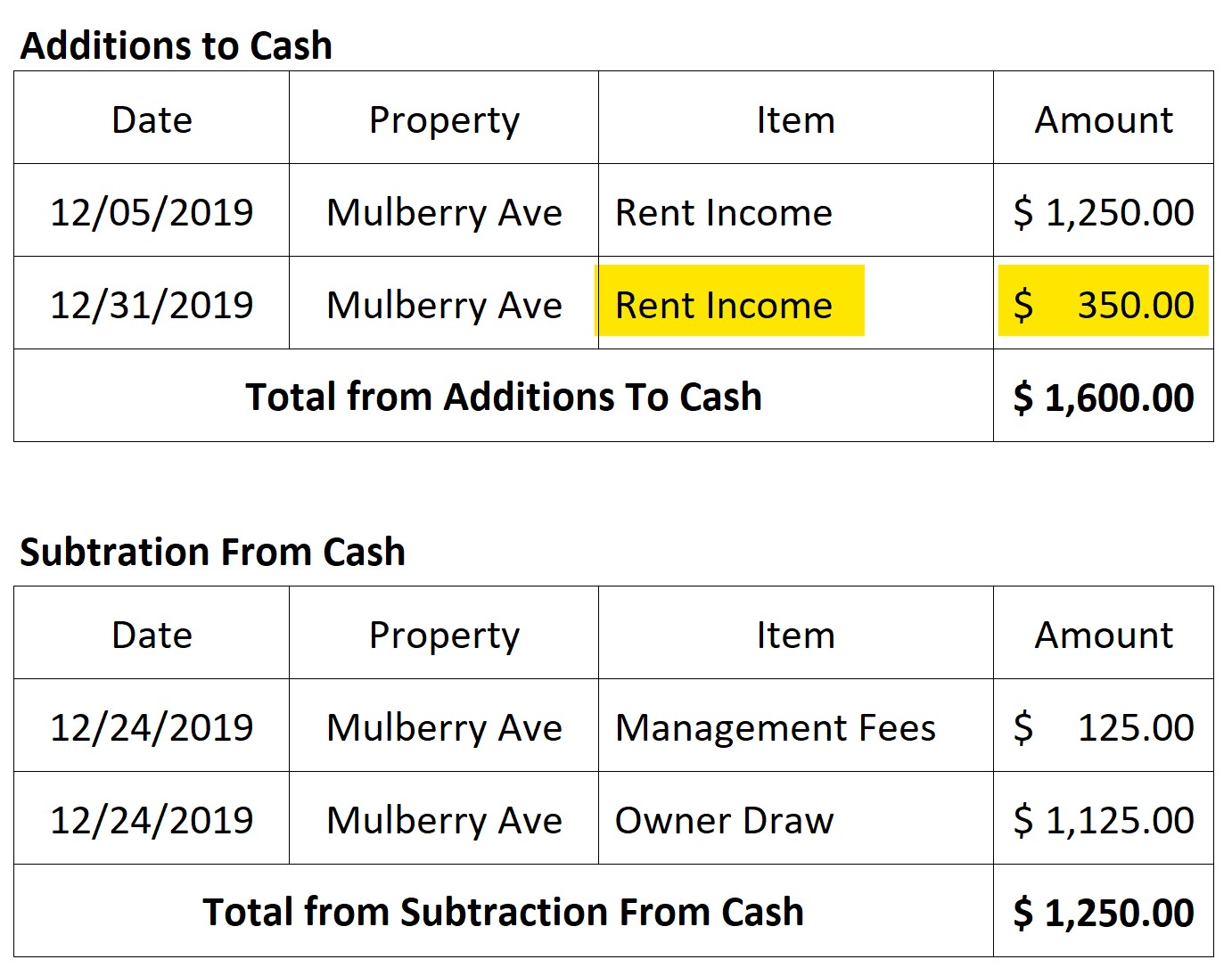

What if we just copy the transactions from the property management company to QuickBooks? This way, all the income and expense will be recorded at the right dates. The QuickBooks transactions will look like this.

While this solved the problem of under or over reporting the income & expense, this will create a problem when reconciling with the bank account. While the actual bank transaction will only have one transaction of one owner draw deposit, QuickBooks will have multiple transactions with no owner draw transactions.

While the balance will eventually match up, this will make it much harder to do the reconciliation. So what is the solution?

Creating an extra "Other Current Asset" account:

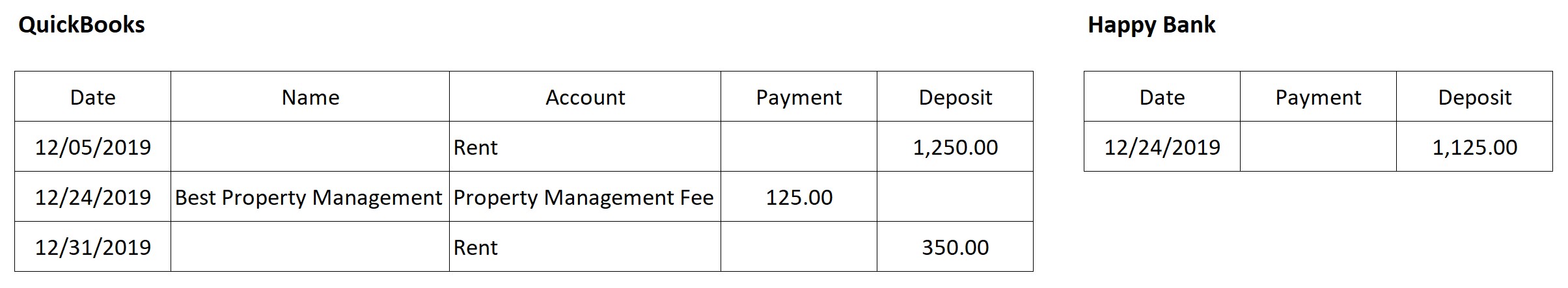

It's simple. Just create "Other Current Asset" account called "Fund held by PM" that will have all the property management company's transactions. Next, when the property management company deposit the owner draw to your bank account, simply enter that transaction to QuickBooks by depositing the money from the "Fund Held by PM" account to the bank account. The QuickBooks translations will look like this.

This way, the actual bank transactions and the bank transactions within QuickBooks will match. Also all the transactions happening within the property management company will match the QuickBooks transactions within the "Fund Held by PM" account. You will have the accurate record of income and expense.

Note: "Vendor" was used to pay for the rent for the first 2 videos. While you will receive the rent payment (minus the management fee, etc.) from the property management company, it's better to "Received From" tenants, just like the 3rd video.